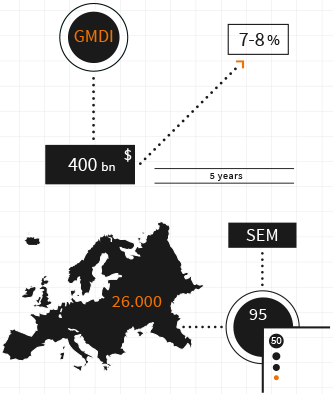

However, this doesn’t mean that the SME’s which comprise the vast majority of European Med Tech companies can rest easy. On the contrary, as they control less than 10% of the market, they either try to destroy each other to maintain a foothold and or enter new areas of the market before the blue-chip monoliths arrive and reassert dominance through acquisition, merger or increased R&D investment.

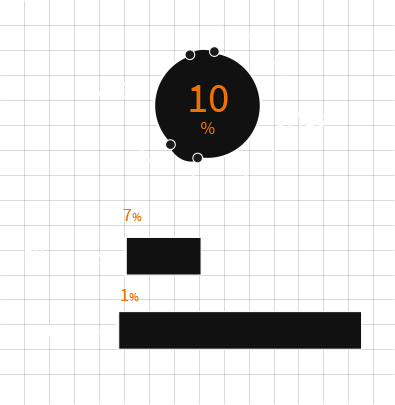

The modern device market, on average, makes up 7% of total healthcare spending in the EU, less than 1% of total GDP. Wider economic considerations and shifting regulatory parameters have resulted in an already shallow reimbursement and investment stream beginning to run dry.

In place of the R&D focussed barometers of the past - safety, efficacy and incremental development/improvement in patient outcomes - stakeholders are balancing health economics against tangible improvements in patient outcomes.

Companies need to keep pace and deliver clear improvements in patient outcomes while satisfying price conscious purchasing groups who have an inherent suspicion of marginally upgraded technologies.

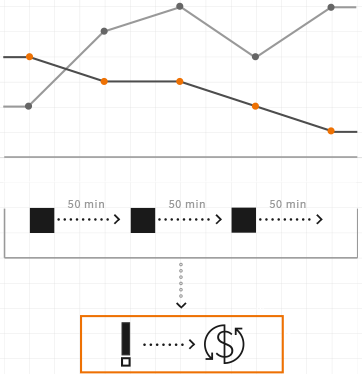

Industry leaders agree that the key to continued growth in the industry is innovation, but the traditional definition of innovation may require modification. Manufacturers and developers are facing multi-stakeholder appraisal at each stage of the product life cycle, from original development to commercialisation, and satisfying the varying, and sometimes contradictory, demands of that process is key to success.

The navigation of this pathway requires a highly skilled team capable of counterbalancing the traditional aims of a medical technology manufacturer against the economic realities of stretched healthcare budgets and burgeoning, ageing populations.

-

Executive Search

more_horiz

Executive Search

Strategising for the future often means working towards a scenario beyond the current resources of the business. Our Executive Search service bridges the gap between plans and eventual reality. We give you the confidence to plot the evolution of your company safe in the knowledge that key hiring needs will be met.

-

Team Build

more_horiz

Team Build

To build your team inline with your culture and business goals we become a part of it ourselves, developing our understanding of what and who will be compatible within your company, developing a scalable, repeatable plan for identifying the people you need, with the skills you need, where you need them.

-

Recruitment Process Outsourcing

more_horiz

Recruitment Process Outsourcing

Prolonged spikes in recruitment activity are very often necessitated by high growth periods. These periods of opportunity require a steady hand to maximise their effectiveness. Through our Recruitment Process Outsourcing service we absorb the straining elements of making new hires; removing bureaucracy and legwork from your team, letting you get on with building the future.

-

GS Compass

more_horiz

GS Compass

New hires shape the future of businesses, since the impact of a new hire can never be fully predicted, the future of any company remains at least a partial mystery. GS Compass is our custom designed; cloud technology based Search & Selection process created to deliver unprecedented predictability in new employee performance, minimising the unknown, decreasing risk.

FIND

FIND  Submit

Submit  SPEAK TO THE

SPEAK TO THE  FIND

FIND